How to report a foreign gift according to government requirements

Exactly How Legal Provider Can Help You in Reporting a Foreign Present: Key Truths and Insights

Steering with the complexities of reporting international gifts can be intimidating for people and organizations alike. Lawful services supply crucial know-how in understanding the detailed regulations that regulate these deals. They aid identify prospective threats and establish tailored conformity approaches. However, lots of still face difficulties in ensuring adherence to these requirements. This triggers the query of how effective legal support can absolutely improve compliance and alleviate dangers related to foreign gift reporting.

Understanding the Legal Structure Surrounding Foreign Present

While the acceptance of foreign gifts can enhance worldwide relationships and foster collaboration, it also raises complex legal considerations that organizations should navigate. The legal framework regulating foreign gifts incorporates different laws and guidelines, which can differ markedly throughout territories. Organizations should know guidelines concerning the disclosure, valuation, and possible taxes of these gifts.

Compliance with government guidelines, such as the Foreign Representatives Enrollment Act (FARA) and the Greater Education And Learning Act, is vital for organizations obtaining substantial foreign payments. These laws intend to assure openness and prevent excessive influence from foreign entities.

Furthermore, institutions need to think about ethical guidelines that govern gift approval to preserve integrity and public trust fund. By comprehending these lawful details, companies can better handle the risks connected with international gifts while leveraging the possibilities they present for worldwide cooperation and partnership.

Trick Reporting Demands for Individuals and Organizations

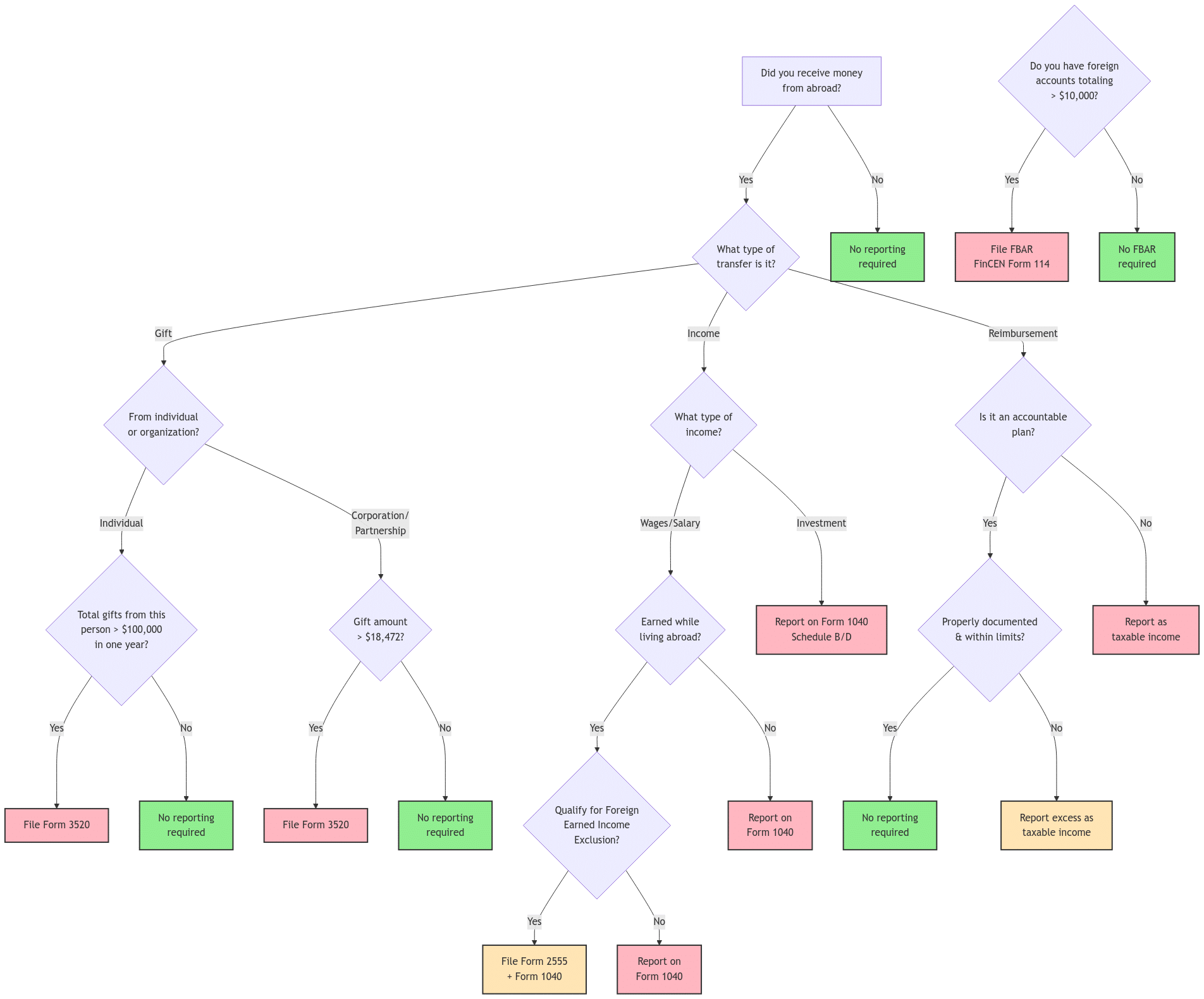

Organizations and people receiving international presents need to abide by certain coverage requirements to ensure conformity with legal responsibilities. These needs differ depending on the jurisdiction and the nature of the present. Usually, recipients are mandated to divulge foreign presents going beyond a particular financial threshold to appropriate government companies. This may consist of comprehensive info concerning the benefactor, the worth of the present, and its intended use.

In the United States, as an example, the Foreign Representatives Enrollment Act (FARA) and the College Act enforce unique reporting requirements - report a foreign gift. Institutions should make sure that their reporting lines up with suitable regulations to stay clear of charges. People might additionally require to report gifts gotten in their capability as public authorities or workers

Comprehending these requirements is essential, as failure to report appropriately can lead to lawful effects. Consequently, interesting lawful services can assist in compliance and assistance navigate the intricacies of international present reporting.

Common Compliance Difficulties and How to Overcome Them

Steering the intricacies of international gift coverage usually offers substantial conformity challenges for receivers. One typical issue is the ambiguity surrounding the interpretation of a "foreign gift," which can lead to unpredictability regarding what has to be reported (report a foreign gift). Furthermore, differing state and federal regulations can make complex adherence to coverage needs, especially for companies operating across territories. Receivers may likewise battle with keeping precise documents, as failure to document presents properly can result in non-compliance

To get rid of these difficulties, receivers should develop clear internal plans concerning international presents, ensuring have a peek at these guys all team are trained on conformity requirements. Routine audits of present records can assist recognize inconsistencies early. In addition, seeking advice from compliance experts can offer clarity on nuances in guidelines. By proactively addressing these hurdles, receivers can much better navigate the reporting process and minimize the threat of penalties connected with non-compliance.

The Duty of Legal Services in Navigating Foreign Gift Rules

Steering through the elaborate landscape of international present regulations can be daunting, particularly provided the prospective lawful implications of non-compliance (report a foreign gift). Lawful solutions play a necessary duty in leading individuals and organizations with this complicated terrain. They supply expert evaluation of the appropriate guidelines, ensuring clients fully understand their responsibilities pertaining to international presents. Additionally, lawyers aid in recognizing possible dangers and obligations related to non-disclosure or misreporting

Best Practices for Ensuring Compliance With Foreign Gift Coverage

Conformity with foreign present coverage needs necessitates a positive technique to prevent possible mistakes. Organizations ought to develop a clear policy laying out the standards for determining and reporting foreign presents. Routine training for personnel included Clicking Here in the approval of gifts is important to guarantee they understand reporting responsibilities and the ramifications of non-compliance.

In addition, maintaining comprehensive records of all international presents obtained, including the donor's identity, value, and purpose, is critical. Organizations should execute an evaluation process to analyze whether a gift qualifies as reportable.

Involving lawful solutions can additionally strengthen conformity initiatives, supplying advice on complex regulations and potential exceptions. Consistently assessing and upgrading internal policies in line with governing adjustments will help organizations continue to be certified. Finally, cultivating a business culture that prioritizes openness in present approval can alleviate risks and enhance accountability.

Often Asked Questions

What Sorts Of International Presents Require Reporting?

International presents calling for reporting typically consist of considerable monetary payments, residential property, or benefits gotten from foreign entities, federal governments, or individuals, specifically those surpassing details monetary limits set by laws, requiring openness to avoid possible conflicts you can find out more of passion.

Are There Fines for Stopping Working to Report an International Gift?

Yes, there are charges for stopping working to report an international gift. The repercussions can consist of fines, lawsuit, and prospective damages to a person's or company's reputation, emphasizing the value of compliance with reporting requirements.

Can I Obtain Legal Help for Foreign Present Coverage Issues?

Legal help may be available for individuals facing challenges with international present reporting issues. Qualification commonly depends upon monetary need and particular scenarios, motivating possible recipients to get in touch with local legal aid companies for help.

How Can I Track Foreign Present Obtained Over Time?

To track international gifts in time, people should keep thorough documents, consisting of dates, quantities, and resources. Consistently utilizing and evaluating economic declarations tracking software application can boost precision and streamline reporting commitments.

What Documents Is Needed for Foreign Present Reporting?

Documents for international present reporting typically includes the donor's info, present value, date received, a summary of the present, and any kind of appropriate communication. Precise records assure compliance with reporting demands and help stop possible legal concerns.

Organizations and individuals getting international presents should stick to specific coverage requirements to assure compliance with legal obligations. Maneuvering through the detailed landscape of foreign present guidelines can be intimidating, especially provided the potential legal implications of non-compliance. By leveraging legal solutions, customers can navigate the intricacies of foreign gift guidelines more successfully, thereby reducing the risk of charges and promoting conformity. Lawful help may be readily available for individuals dealing with difficulties with international present reporting problems. Documentation for international present reporting normally includes the contributor's details, present worth, date obtained, a summary of the present, and any type of relevant communication.